These Buy-Now-Pay-Later (BNPL) Statistics Prove it’s the Biggest Fascination to Ever Hit Ecommerce

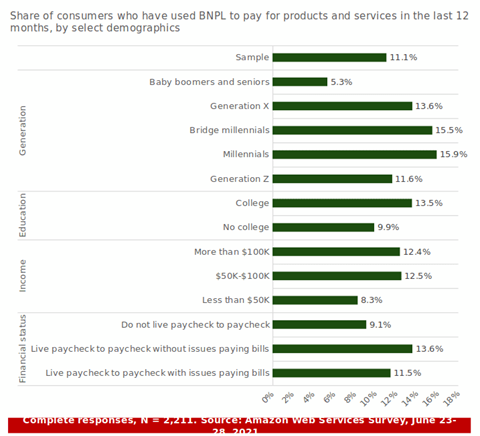

Buy-Now-Pay-Later has seen a revival and immense growth over the past couple of years since the start of the pandemic. This type of payment plan has been available for years, but economic uncertainty, inflation and income loss has compelled Americans to find new ways to conserve and borrow money. BNPL has been incredibly popular with younger people, but the older demographic is certainly not shunning its use either.

Read on to learn more about what Buy-Now-Pay-Later is, the benefits for both retailers and consumers it offers, and all the pertinent BNPL statistics you need to know.

What is BNPL?

What is Buy-Now-Pay-Later? As its name suggests, BNPL enables you to make a purchase of an item, receive it at once and pay for It later, typically over a period of installments. BNPL is a type of installment loan dividing your purchase into multiple equal payments. The first payment is due at checkout and the rest will be billed to your debit or credit card until the purchase is paid off.

These types of loans can incur interest and late fees but depending on the provider and the plan neither may be charged. Consumers need to be aware of how BNPL works and the specifics of the plan they are entering. If they fail to make a payment on time it could possibly put their credit in jeopardy.

How does BNPL Work?

BNPL is becoming popular both offline and online, but one of the most usual places it’s come across is at checkout online. During checkout you will see an option to split up your total purchase by paying a small amount now instead of the full price.

If you select this option, you will fill out a short application that includes information regarding your name, address, date of birth and phone number directly on the checkout screen. You will then provide a payment method and the BNPL provider may perform a ‘soft’ credit pull which does not affect your credit score. Your approval or denial of the application will happen in a matter of seconds.

Criteria for approval varies, but you may still be eligible even with bad or no credit.

Plans vary by provider, but many offer a “pay in four” model, which will split your purchase into four equal installments. Each payment will be due two weeks apart with the first due immediately.

As an example, if your total purchase price is $125.00, you will pay $31.25 at checkout and then have three remaining payments of $31.25 each two weeks apart. If you make each payment on time, you will pay off the purchase in six weeks.

“Pay in Four” typically does not charge interest, but some BNPL charge an annual percentage rate up to 30%. Late fees range between $7 to $8 and typically are capped at 25% of the value of the purchase.

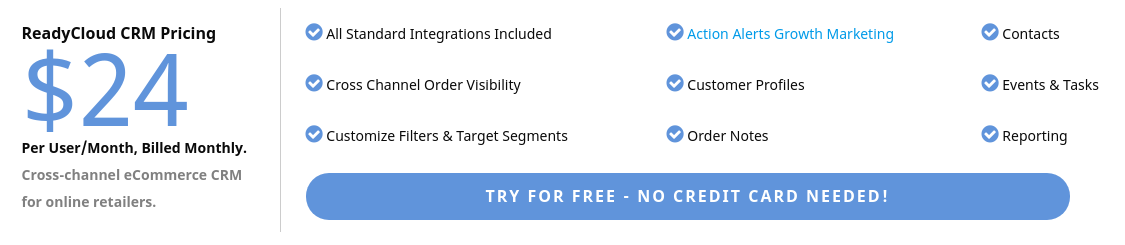

Buy-Now-Pay-Later Statistics

Of all the statistics on BNPL we could find to help drive home the important of these payment option in ecommerce, these ones are the most important.

- 8% of consumers have used a buy now, pay later service, up from 37.65% in July of 2020 — an increase of almost 50% in less than one year.

- Buy now, pay later usage growth was largest in the 18 to 24 (62% growth) and 55+ (98% growth) age groups between July 2020 and March 2021.

- 53% of respondents who have never used BNPL say they’re at least somewhat likely to use it within the next year.

- Among BPNL users who have used the service more since the pandemic started, 41% say they’ve done so to conserve cash in case of an emergency, while 25% say it’s because they lost income.

- 31% of BPNL users have made a delinquent payment or incurred a late fee. 36% of BNPL users say they are at least somewhat likely to make a past due payment within the next year.

- 62% of buy now, pay later users think BNPL could replace their credit cards, though only about a quarter want that to happen.

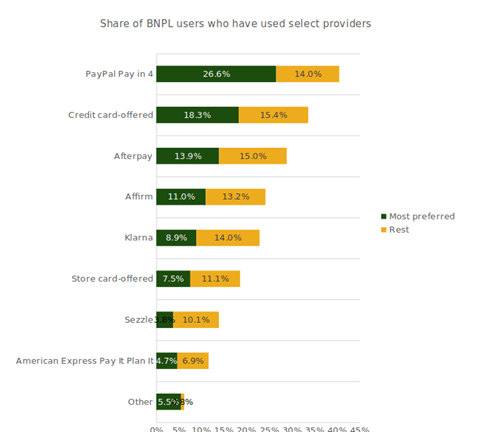

- PayPal’s buy now, pay later services are the most used among providers, with 43% of users saying they’ve used the brand’s BNPL options.

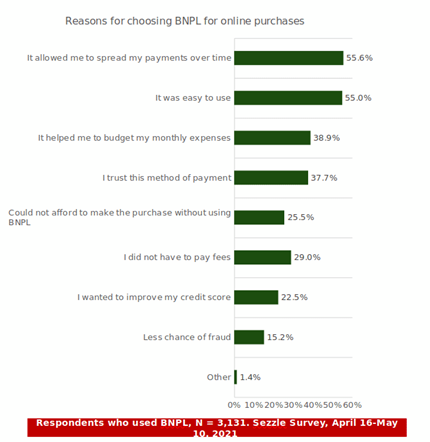

- The most common reason to use BPNL services is to make purchases that don’t fit in one’s budget — 45% of respondents have used it for this reason.

- Buying electronics is the most common use of BPNL, with 48% of users saying they’ve used it for that reason.

- 36% users make use of BNPL once a month or more.

- Buy now, pay later users aged 18 to 24 are the most likely to pay $250 or more per month when they have a BNPL payment.

- Americans understand BNPL significantly better than they did last year, with a nearly 50% increase in the number of people who say they understand it at least somewhat well.

- 61% of BPNL users would rather use a BNPL service offered directly from the retailer they’re buying from than going through a third party.

BPNL Benefits for Retailers

What immediate benefits do retailers gain from adding BNPL to their toolkit? Let’s take a look.

- Higher conversion rates: According to Statista, in March of 2021 over 80% of online shopping carts were abandoned. Some estimates suggest that online businesses lose about 75% of their sales due to online cart abandonment. Point-of-sale financing such as BPNL enables customers to make purchases even during lean financial times while also allowing them to take advantage of sales and promotional discounts being offered from your online store.

- Larger sales pool: With BNPL, customers that would otherwise not be able to make a purchase can do so because of its affordability and divided payments. This enables you to reach a wider sales pool including the younger demographic.

- Higher average value of orders: BPNL offers the opportunity for you to sell higher value items to customers because of equal divided payments increasing their purchasing power. According to Guidance, the average order value (AOV) has seen an increase of nearly 45% depending on the BNPL plan chosen.

- Improved customer experience: Customers are happier when they are given more control and flexibility over their purchasing decisions. A BNPL system offers that flexibility which empowers your customers and improves the overall customer experience.

BPNL is Changing Ecommerce

When implemented successfully, BPNL helps both the customer and retailer. Customers have the ability to make larger purchases, conserve cash and still get the items they desire. Retailers increase profit margins, reach a larger consumer base while also staying relevant to consumer expectations in today’s ever evolving world of ecommerce.

If your business has not added a BNPL system to your online store, now is the time!

Share On: