The biggest shopping weekend of the year has commenced and. Once again, Cyber Monday and Black Friday weekend unsurprisingly set new all-time records in the ecommerce space. What did the numbers look like and how did things pan out this year versus last year or the year before? Here’s the scoop.

Between November 29th and December 2nd, 2019, consumers opened their wallets and shelled out a whopping $7.4 billion on Black Friday—a dramatic increase in spending year over year—and a record-setting $9.4 billion on Cyber Monday—a 15% increase in spending year over year.

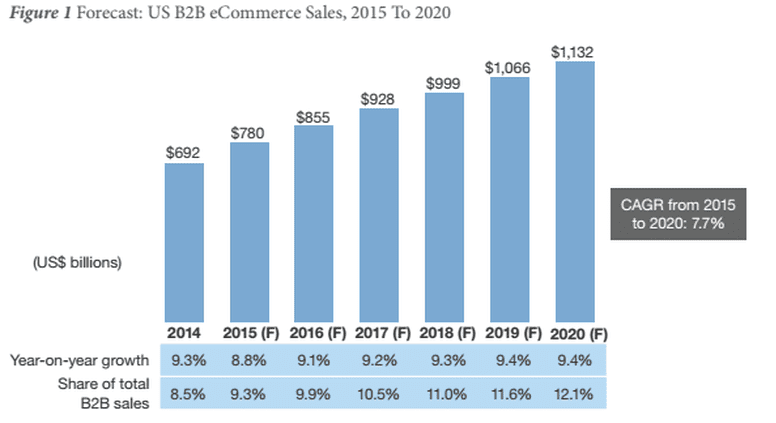

Among the most interesting of Black Friday and Cyber Monday statistics for 2019 was the fact that smartphone shoppers dug deep in their pockets, wracking up more than $3 billion in mobile sales. But this is just the tip of the iceberg, folks. Furthermore, this is all in par with Forrester’s wildly accurate predictions for ecommerce market growth through 2020.

Keep reading for our complete rundown of everything you need to know about Black Friday and Cyber Monday’s massive hauls for 2019.

2019’s Black Friday/Cyber Monday Statistics

Last year, we predicted in our BFCM blog that Cyber Monday sales would top $7.5 billion in 2018, and they did! A quick comparison from what 2017’s statistics looked like is telling. What we could have never predicted, though, is that Black Friday and Cyber Monday would have posted the significant gains that they did year over year.

What do the numbers look like now that this event has concluded?

Here’s a looksee:

- Mobile sales increased by a staggering 35% for Black Friday and 16% for Cyber Monday.

- Shopify reported that 70% of transactions from its stores took place on mobile devices.

- Thanksgiving revenue increased overall by 26% year over year.

- AI recommendations helped increase average order value by 9% overall.

- Cyber Monday had the highest average order value at $122.

- Mobile purchases accounted for approximately 49% of all orders.

- 58 million shoppers made a purchase online while 51 million shopped in stores.

- Millennials shelled out an average of $419 per person.

- Surveys found that 50% of shoppers preferred to buy online.

- More than $5 billion was spent online in the U.S. during the first 24 hours.

- 190 million American shoppers made at least one purchase over this weekend.

- $9.4 billion was spent online during Cyber Monday.

- $7.4 billion was spent online during Black Friday.

- Buy online, pickup in-store purchases soared by 41%.

- $11 million was spent each minute over this weekend.

The Webrooming Effect

A common method that shoppers use to the find the best deals during this popular holiday shopping weekend is called webrooming – where shoppers look to find the best prices between multiple stores on the goods they want to purchase. Another way shoppers strive to find the lowest prices is by using a process called showrooming – where they compare online prices while in-store to get the best deals.

This year, 88% of shoppers webroomed before making a holiday purchase, whereas 76% showroomed while in-store to find the best price.

With 50% of purchases coming from mobile devices, it’s no surprise that 45% of shoppers used a mobile device to webroom. These deal-finders helped set new benchmarks for mobile sales on Black Friday and Cyber Monday, accounting for a whopping $3 billion in smartphone spend on Cyber Monday alone.

Most Popular Items Bought

What kinds of items were shoppers buying the most of this holiday weekend? A reliable source to use is Amazon, the largest online retailer in the world. According to some stats that CNN compiled, here are the products consumers wanted the most this year.

- Hasbro, LEGO Star Wars Darth Vader’s Castle and a “Frozen 2” edition of Monopoly topped the list.

- Instant Pot Duo80, a DNA kit from 23andMe, L.O.L. Surprise! toys and the iRobot Roomba were the bestselling household products.

- Bedding, socks and linens set new sales records.

- Electronics, gadgets and computers remained popular consumer mainstays.

- Apparel, cosmetics and accessories stayed atop the list of most purchased items.

Buyer’s Remorse: Average Return Rate

In the past, we’ve helped provide some tips on how retailers can prepare their store for the holiday rush and make changes that prevent buyer’s remorse – or the influx in returns that generally follow mass purchases by consumers.

In the aftermath of Black Friday and Cyber Monday, shoppers usually return items they thought they needed but didn’t or products they changed their mind on after the fact. This results in a higher than average 40% holiday return rate (the usual return rate on ecommerce goods hovers at around 33%).

Things that contribute to a high ecommerce return rate include the following:

- Failure to make your return policy easy to find and understand.

- Poorly described products.

- Lack of images, zoom-in options or videos.

- Little or no product reviews.

If your store suffered from high return rates this holiday season and you’re looking to get back on track for next year, we’ve got you covered. Take a look at our related post: The Ultimate Guide to Ecommerce Returns.

All said and done, the USPS will be processing more than 1.4 million returns this year, with services like UPS and FedEx combining to process around 4.5 million returns collectively. During the first week of January, as buyer’s remorse takes full affect, nearly 6.5 million packages are predicted to be returned to retailers, setting new all-time highs on ecommerce return rates post-holidays.

Infographic: Even More BFCM Stats

We leave you with this infographic that entails all the key takeaways from this year’s Black Friday and Cyber Monday shop-a-thons. Feel free to share it on your own blog or social channels.