The heat of July is upon us, but the engine of ecommerce is just starting to churn as the industry prepares for yet another holiday shopping season. It’s widely agreed that July begins the slow march to the yuletide shopping season, a term that’s been coined: “Ecommerce Christmas in July.”

According to IBM’s sixth annual Online Retail Readiness Report, seasonal shopping, “continues to be a really important shopping period. It may be starting earlier and lasting longer, but it’s been growing consistently,” explained Jay Henderson, Director of Product Strategy at IBM.

As online retailers nationwide prepare for the holiday haul, many are prepping their websites, stocking their inventories and preparing their marketing campaigns for what’s assuredly going to be another record-setting Black Friday and Cyber Monday. We’ll take a look at the hard statistical data, and also provide you with a few ways that you can ensure that your store is prepared for the looming seasonal shopping season.

Online Spending From 2009-2015

The most recent ecommerce facts show that last year was the healthiest year on record. U.S. ecommerce sales topped $300bn for the first time, with experts projecting that this year will eclipse the $330bn marker, setting a new record. Take a look at this chart below, which shows the growth of ecommerce from 2009-2015.

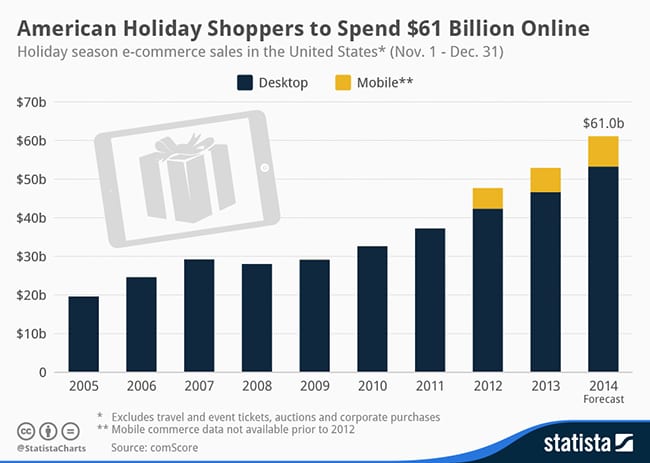

Holiday Shopping By The Numbers

Year-over-year growth has been exponential for the holiday shopping season. According to IBM’s data, retailers have been engaged in a tit-for-tat battle of the clicks. Traffic density has climbed, but alongside of it bounce rates and shopping cart abandonment rates have also peaked.

Mobile Traffic Will Be A Game Changer

In lieu of the recent Mobilegeddon update by Google, retailers have been scrambling to get their sites situated for cross-platform functionality, with estimates by Portent stating that up to 40% of all e-retail mobile sites could be affected if drastic, immediate changes are not put into place.

The most current mobile ecommerce statistics show that last year about 33% of consumers made a holiday purchase from a mobile device. This is inclusive of the two prominent shopping holidays Black Friday (the day after Thanksgiving) and Cyber Monday (the Monday following Thanksgiving).

Considering that 44% internet minutes are spent engaging from a mobile device, with 11% accounting for tablet devices, the impact of mobile shopping this season will be incremental, indeed. According to Nielson, the top-five mobile shopping websites and apps reach and influence as much as 60% of all shoppers during the holiday season.

Desktops, Laptops Still Lead The Way

Nevertheless, while mobile shopping has assuredly become a force, desktops and laptops will still be the primary devices that power an ecommerce Christmas in July. The most recent online shopping facts paint the real picture.

- Desktops and laptops were the preferred holiday shopping device in 2014.

- Smartphones drove about 31% of all shopping traffic, but tallied just 9.1% of sales.

- Tablets generated 13.4% of traffic and sales, converting more than smartphones but driving less traffic.

- About 65% of shopping traffic and an estimated 79% of all sales were driven by desktop or laptop devices.

Cyber Monday Will Set New Records

Unsurprisingly, Cyber Monday set records in 2014, exceeding $2bn in sales for the first time. Interestingly enough, the Saturday and Sunday weekend that followed Black Friday topped $2bn in spending, too. All in all, between Black Friday and Cyber Monday, internet retail sales exceeded $5.5bn, setting a year-over-year record once again for growth.

Take a look at this infographic that illustrates Cyber Monday Facts from 2014. It can provide a detailed example of what the industry is bracing for this time around. With growth expected to exceed 15% this year, it’s easy to understand why this few day span in November is so celebrated by the industry.

Amazon Prime Day Will Compete For Top Slot

With Amazon’s 20th anniversary looming, the marketplace conglomerate has announced “Prime Day,” dubbing it as an online shopping holiday that will set new benchmarks. According to a report by SC Times, the retailer has declared that their Prime Day sales will top Black Friday’s numbers (at least for spending by consumers on Amazon as compared to Black Friday last year).

“On July 16, we will celebrate 20 years of reading,” said Amazon spokesperson, Julie Law, adding, “You will have to stay tuned.”

But could Amazon’s newly coined online shopping holiday dwarf the numbers forecasted for Cyber Monday this year?

Jim McGregor, founder and principal analyst at Tirias Research, thinks so. In an interview with Ecommerce Times, he said, “Amazon sets the bar. I would suspect that if they’re doing Amazon Prime Day — I’m calling it ‘Summer Christmas’ — I’d be surprised if you don’t see other websites following suit.”

If analysts are already predicting this, it’s safe to bet that in the future, the ecommerce Christmas in July could be dominated by Amazon. For online sellers who take part in the lucrative marketplace Prime promotions, this could mean a huge surge in summer spending that normally wouldn’t be so gregarious.

If you look at the chart below, you will quickly realize that Amazon’s selling capacity is monstrous, indeed. It easily outpaces the other top retailers in the landscape by a longshot, and has year-over-year. Given these metrics, it’s safe to presume that the new Christmas in July may in fact someday simply be called: Prime Day.

Webrooming Will Become Normal

As the holiday shopping season (literally) begins to heat up this July, don’t overlook the importance of two vital elements for consumers: webrooming and showrooming. The most recent reports find that shoppers drop an average of $800 for holiday gifts, with about half of that money being spent online.

- Think tank Accenture reports that about 65% of all shoppers will look for a product online before they end up making a purchase of that same product locally (webrooming).

- Internet Retailer says that about 36% of shoppers will shop online but then go and pick up a product for local pick-up.

- 42% of shoppers are going to spend money online regardless.

- 50% of consumers will take their business to online-only stores like Amazon.

Social Shopping Will Drive High-Value Referrals

Don’t forget about the juggernaut mass appeal of the major social networks, either, because they will play a strong role in facilitating referral sales this year, starting in July and all the way through the holiday shopping rush. The most recent social shopping statistics demonstrate the imminent influence of social media on consumer buying patterns.

- According to Statistica, over 157 million people made a purchase due to a social referral in 2013.

- Media Bistro says that 75% of people using Twitter buy at least one item online each month.

- A Sprout Social study finds that 74% of consumers use social networks to help them make an online buying decision.

- Invesp says that an estimated 5% of holiday shopping will come from social media this year.

[mk_padding_divider]

The Holiday Shopping Rush Starts Now

But, really, Black Friday and Cyber Monday, while amazing revenue haulers for the ecommerce industry, do not denote the start of the holiday shopping rush, by any means. In actuality, the rush begins with an ecommerce Christmas in July. And that rush, dear reader, is already well underway.

A CS Monitor report finds that many of the largest online retailers actually begin their season sales in July.

- Retailers like Target announce early sales in July that are comparable to their Black Friday events.

- From July 24-25, Best Buy hosts a run of special sales events.

- A Cabela’s ad features a Christmas in July sale for this month.

- Shoppers can find early holiday deals on QVC in July.

- Amazon, is touting their Prime Day event.

Are You Prepared?

Want to get more conversions this year during the holiday season? Then you need to get your SEO game plan started as soon as possible. Have a look at this SEO roadmap that can give you all the tips that you need to optimize your store in time to attract the most traffic during the holiday shopping season this year.