Ultimate Guide To Black Friday & Cyber Monday

Black Friday and Cyber Monday are two terms that have canonized the colloquial holiday shopping season, pitting the demographic into two shopping statistics: brick-and-mortar and online shopping. But they could very well merge into one metric as trendsetting shoppers change the gambit of how the holiday shopping season ebbs and flows.

Half of Holiday Spending Will Be Online

A recent CS Monitor article underscores this notion, culling stats from an NRF survey that revealed that approximately 44% of all holiday shopping will be done online this year, with much of it occurring during the Black Friday season. This is atypical of the classic holiday rush into retail stores, most of which purposely host late night hours on Thanksgiving Day and the hectic Friday that follows.

Shoppers Plan on Opening Their Wallets

The same report also revealed that 56% of all shoppers in the U.S. plan on doing at least “some” shopping online, an increase from 51.5% in 2013. Per person spending over the holidays has been pegged at $804.22, an increase of 5% since last year. Leading the pack are Cyber Monday department store sales, which are predicted to increase by over 70% since last year, with mobile spending up a whopping 52% since 2012.

Holiday Sales Set to Soar

The National Retail Federation recently released their annual holiday sales prediction, and the numbers look inspiring, indeed. Holiday sales are set to increase by an estimated 4.1% this year, topping $619 billion; 2013 only saw a 3.1% increase. Shop.org has predicted a healthy online increase in sales, too, to the tune of an 8-11% increase from last year; an estimated increase of as much as $105 billion this year. Other sources are saying that the U.S. will top $330 billion in sales this year.

One-Third of Products Will be Returned

Online retailers need to be as prepared as possible prior to the Black Friday and Cyber Monday rushes, because returns will most certainly follow. A recent Wall Street Journal report found that one-third of products bought online are ultimately returned by shoppers. Given the aforementioned statistics, it’s presumable to estimate that over $150 billion in goods will be returned to online stores this year in the aftermath of the shopping rush.

Middleman Resellers Will Shop with Proxies

Another thing that you can expect to see during this year’s online shopping cavalcade are middleman resellers using 4g residential proxies to mask their IP so they can cash in on the wide gambit of doorbuster deals that are going to be offered online. With the use of proxy technology, these savvy shoppers can grab up limited-edition goods faster than other shoppers, and can use proxy packages to mask their identity, cashing in on the rock-bottom prices that are offered when Cyber Monday kicks off, but then reselling the products later at a handsome markup.

Online Return Rate Lowest in Industry

Don’t get too worried, though, because online ecommerce merchants actually have the lowest rate of returns overall. According to Internet Retailer, which polled 500 different entities to comprise their statistics, online-only vendors have an average online product returns rate of just 3.75%; as compared to brick-and-mortar retailers, which have a 4.96% average rate of returns.

The Return Policy Matters

A Harris Interactive poll, which queried over 1,000 shoppers, of which 70% regularly shopped online, found that a staggering 92% of shoppers were likely to make repeat purchases if a “convenient” returns policy was offered. What’s more, 88% of respondents said that an easy returns policy was “somewhat important, important or very important” to them making a purchase.

Free Returns Can Boost Future Sales

Interestingly enough, and contrary to popular belief, offering free, no-questions-asked online product returns (such as those that are offered by juggernauts like Amazon and Zappos) has the potential to substantially increase future sales. In 2011, returns cost retailers $17 billion. But a 49 month study that tracked the habits of shoppers at two major online retailers, as was covered in a CNBC report, found that when a free return shipping policy was offered, the average spending per customer increased by $620 over two years at one company, and by a staggering $2,500 over two years at the other.

Is Black Friday the New Cyber Monday?

For online retailers, Black Friday still has not surpassed Cyber Monday stats, but that’s not for lack of trying or getting close to the mark. A Google AdWords report found that Black Friday (2013) had a 117% lift in online transactions, as compared to Cyber Monday (2013), which had a 170% lift in transactions. With a lift difference of 53%, it’s safe to say that Black Friday is the second most popular time of the year to shop online, set apart from its Cyber Monday cousin by only two short weekend days (which also happen to be the third and fourth most popular times of the year to shop online).

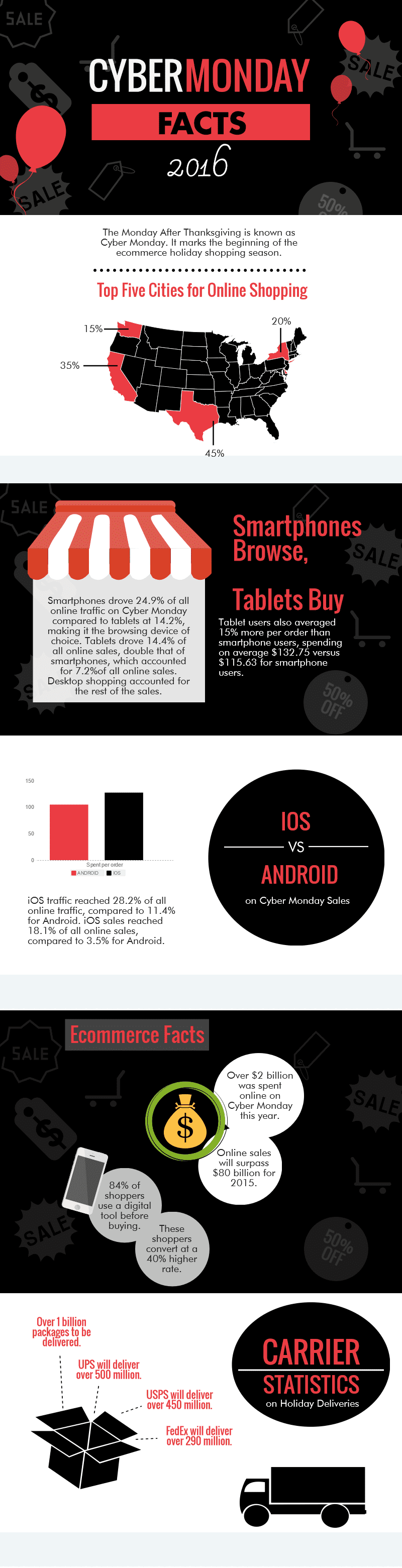

Cyber Monday Facts

It all starts with Black Friday – the first Friday following Thanksgiving. This is typically the busiest time of the year for retailers, with a majority of these sales taking place offline in a brick and mortar setting. But the Monday that follows is the largest online shopping holiday of the year, an event that has become so profitable it’s been named Cyber Monday.

In fact, the entire four-day span of Friday through Monday following Thanksgiving represents the peak time for retailers. During these four short days, most retailers do more business than they would do the other 361 days of the year. As you might suspect, everyone is trying to cash in on a slice of the holiday shopping pie. We’ll help you stay ahead of the game with our breakdown of the most pertinent Cyber Monday facts.

Cyber Monday Fact: Apparel is the most popular item that’s purchased during this colloquial holiday shopping rush, according to the most recent online shopping facts. Electronics actually come in second place, contrary to popular belief. Apparel accounts for about 67% of shopper’s money, with electronics, food, beverage and entertainment accounting for the next three positions in most purchased items between Black Friday and Cyber Monday.

Cyber Monday Fact: Most shopping is split between where shoppers choose to spend their money, with local stores getting their even take of the booty. For example, 85% of children’s toys and games are purchased online during the four-day shopping span that follows Thanksgiving, whereas just 47% of electronics are bought online during this time (namely because shoppers want to touch and feel the electronics as well as see them in person before making a purchase).

Cyber Monday Fact: Cyber Monday is gaining headway on Black Friday in recent years. For example, online spending outpaced Black Friday by 10% between 2012 and 2013. It is on course to be up by 22% year-over-year, once the numbers have been crunched for variances in spending between 2014 and 2015. As online shopping becomes more convenient, shoppers are choosing it over the crowded local holiday shopping experience in the ever growing battle of bricks vs. clicks.

Cyber Monday Fact: Big Box retailers still haul in the most loot during this shopping rush. For example, Amazon took in 37% of Black Friday purchases in 2013, but dominated online shopping, accounting for 78% of all purchases. Still, larger retailers like Target, Best Buy and Wal-Mart dominated local shopping, too, sharing the top three percentages. Basically, brick and mortar rules Black Friday whereas online marketplaces rule Cyber Monday.

Cyber Monday Fact: Webrooming and showrooming are still an integral aspect of the online shopping experience. During Black Friday in 2014, 63% of shoppers compared deals online before making a purchase locally. By comparison, during Cyber Monday (that same year), 83% compared prices online to those being offered locally before they made a purchase.

Cyber Monday Fact: Cyber Monday is on a rapid course to overtake Black Friday spending. In 2013, Cyber Monday sales tallied $2.29 billion, which represented a healthy 16% increase from the year prior. Desktop sales accounted for $1.73 billion of this total, telling of how many shoppers are still preferential to these devices when hunting for holiday ecommerce deals. Increase these numbers by about 15% year-over-year, and you can imagine what 2015’s statistics look like.

Cyber Monday Fact: Mobile shopping is making some headway in recent years, with 18% of shoppers using their mobile device to shop at various retailers last year. The most telling fact is that mobile sales accounted for 13% of all holiday shopping online in 2014, which represents a stark increase of 96% since 2012.

Cyber Monday Fact: Holiday rush shoppers lack a lot of patience when shopping online. Recent studies found that 74% would abandon a mobile site if the loading time was greater than five seconds. A slow and sluggish site was found to deter as much as 46% of visitors. And, conversions dropped by as much as 10% for slower loading websites.

Cyber Monday Fact: Tablets and smartphones drove 41% of traffic last year during Cyber Monday and Black Friday, as mobile shopping soared. But desktops and laptops still dominated with the larger share of 59% of all online traffic. Overall, sales online were up 8.5% from 2013 to 2014, and total orders shot up by a healthy 15% as well. The average order value for smartphones increased by 9% at $99.67, while the average order value for tablets improved by 13% at $121.24. Desktop and laptop spending increased by 20%, with an average order value of $128.24.

Cyber Monday History

In the late 90s, online shopping was pegged as the next greatest thing. It was a time when internet stores first began to emerge as game-changers during the dotcom boom. Then brick and mortar retailers wised up. Many big box stores started opening online stores to quickly follow suit and attract the flurry of online shoppers, who had just been introduced to the first paperless way to shop, one that was devoid of the 500-page catalog and annoying checklist order form.

In 2005, a press release that was issued by Shop.org coined the term Cyber Monday. It claimed that researched showed that over 70% of retailers saw a drastic increase in sales during this day. In 2010, Cyber Monday officially became the biggest spending day of the year for online shoppers, exceeding $1.028 billion in sales. Since 2005, sales have increased by at least $100 million or more each year.

Fast-forward to the present day, and Forrester Research has estimated that shoppers will do nearly $250 billion in business this year alone in the U.S. and about $150 billion in the E.U., with an estimated worldwide take from online shopping thought to be near the $1.5 trillion marker.

The average shopper, according to recent studies, spends over $800 on gifts over the holidays, with about half shopping for them online. Two common strategies will be implored by shoppers this holiday season: webrooming and showrooming; the most pertinent of Cyber Monday facts. We’ll tell what they are and how they can help or hurt your online store, so that you are as best prepared as possible to cash in this forthcoming holiday shopping season

Webrooming is the New Trend

It’s probably not what you wanted to hear, but according to a recent study that was conducted by Accenture, 65% of shoppers will browse for the items that they want to buy online first, and then will actually visit a local store to make the purchase. This is a process that has, in recent years, been coined as “webrooming.” It’s the same as window browsing locally, but is referred to as this nomenclature when done online with the intent to make a local purchase.

Two predominant reasons were at the fore for as to why shoppers plan on doing this, according to the study:

- 47% simply want to avoid paying shipping costs.

- 46% want to actually be able to see the product in person and touch it before buying it.

Interestingly enough, some shoppers will buy online, but then head to the store to pick-up their purchase. An Internet Retailer survey of 500 U.S. consumers found that 36% of shoppers will make a purchase over the internet for an in-store pickup.

Yet, still, there’s plenty of money to be had for the online retailer. That’s because the same survey also found that 42% of respondents still plan to spend about half their holiday shopping budgets at e-retailers. And 50% of those shopping online this year plan to shop at online-only stores, an increase of about 6% from the previous year.

Cashing in on Webrooming

To make the most of webrooming and scrupulous consumers, take some notes on these following pointers and make sure you are prepared for Black Friday and Cyber Monday to really cash in on the holiday shopping frenzy.

- Make sure that you offer an attractive and easy-to-use, fast-loading online store that is seamless from desktop to mobile devices.

- Assure that your product descriptions are short, specific and detailed.

- Offer plenty of pictures that depict multiple angles and viewpoints of the products that you have to offer.

- Feature free or low cost shipping with guaranteed delivery dates.

- Introduce a generous returns policy (like Zappos offers).

- Cater to customers by offering them unwavering shopping support.

- Make checkout a short, fast and one-page process with a guest checkout option.

- State your shipping costs upfront during the checkout process so there’s no confusion later.

Showrooming Can Bolster Sales

The same aforementioned Accenture report also found that showrooming will be a very viral concept this year during the holiday shopping season. Showrooming is where a buyer finds something locally and then looks for that same product online in attempts to get a better price. The study on Cyber Monday facts found that over 63% of shoppers plan on showrooming this year, a drastic increase from last year, when only 54% said they planned on showrooming.

- Over 90% of shoppers cited that discounts were very important when making a buying decision.

- Over 48% will be making their primary purchases on products that are offered at discount prices or that are offered on sale.

- Over 60% of shoppers polled said that a discount being offered needs to be greater than 30% off the list price to influence their purchasing decision.

- Over 38% of shoppers are using their smartphones or computers to track product prices this year.

- Over 44% of shoppers will use a price-matching service to find the best deal.

- Over 23% of shoppers desire a generous and extended returns policy when making online purchases this year.

Capitalizing on Showrooming

To attract more shoppers who are showrooming, you will need to be sure that you cater to these emergent trends.

- Be sure to track your competitors’ prices and beat them.

- Offer to match or beat any advertised price at your online store to further earn customers’ business.

- Feature discounts and sales and go all-in for Cyber Monday sales events, assuring that you offer discounts that are 30% off or greater.

- Make sure your store is listed on the price-matching services so you can earn referral traffic from those valuable sources.

- Introduce a holiday extended and generous returns policy while offering the lowest cost shipping prices that you can.

Cyber Monday is officially the biggest ecommerce revenue-driving day of the year, shattering last year’s record and setting a new one. Sales surpassed $2 billion for the first time. By comparison, the Saturday and Sunday that followed Black Friday generated $2.1 billion combined.

The IBM Digital Analytics Benchmark Report found that online sales increased by 8.5% as compared to last year. While the increase is not as healthy as some had projected – Cyber Monday in 2013 grew 20% over 2012 – it still is the biggest ecommerce money-maker of the year by and far. From 2013 to 2014, a 22% increase was seen. As for 2015… those facts remain to be seen.

Get the Facts

Want to stay ahead of the curve in what’s shaping up to be one cavalcaded online shopping rush this forthcoming holiday season? Need more info about the seasonal shopping rush? Check this infographic, it delivers all the Cyber Monday facts you ever needed to know.

Share On: