Amazon Statistics That Make Your Head Spin

Amazon is widely considered to be the leader in ecommerce, and for a long list of good reasons, too. This behemoth marketplace brings together merchants and sellers, creating a unique synergy that results in one of the greatest e-retail concepts ever contrived, and that delivers a menagerie of shopping, services and more that are truly a one-of-a-kind creation.

What began 20-someodd years ago in a garage as an online bookselling endeavor has intrepidly evolved into a retail giant that is feared and respected by other retailers. The truth is that Amazon really has become an unstoppable force in ecommerce. But since it allows all stores to sell via its platform, it really is not trying to compete, either. Rather, Amazon naturally dominates as a result of this intrinsic, unconventional approach.

During its tenure, Amazon has set benchmark after benchmark, often reinvesting its sole revenue to help spur interior company growth – which generally results in few profits being posted or quarterly losses. While the demure of investors is consequential, the results of this interesting operational protocol have culminated in what has become one of the most desired shopping portals online today. The following Amazon statistics we’ll present here will paint this picture for you.

The Growing Prime Giant

Amazon Prime is a giant. They’ve figured out a way to make subscription shopping a trendsetter using a formula that is impossible to replicate. Sellers agree to a very stringent set of terms that include offering free or low cost, two-day shipping with hassle-free returns and competitive pricing. It’s this fortuitous model that has helped cement Prime as the go-to shopping source for millions of people. But just how successful is this ecommerce model?

According to Business Insider, immensely. At $99 per year, you’d think that consumers would be hesitant to sign-up. But with 54 million members and counting, a 35% increase since 2015, people can’t sign-up fast enough. The following Amazon Prime statistics will shock you, and are testament to how effective it’s been in wooing consumers from other competitors.

- Average Prime user spends $625 per year (Business Insider).

- 20 million products are available for Amazon Prime (Recode.net).

- 78% of consumers pay for Amazon Prime to get free two-day shipping (eMarketer).

- 11% of Baby Boomers use Amazon Prime (eMarketer).

- 16% of Generation X uses Amazon Prime (eMarketer).

- 19% of Millennials use Amazon Prime (eMarketer).

- 30% of online shoppers in the U.S. have a Prime membership (Forbes).

- Amazon loses between $1 to $2 billion on shipping Prime goods each year (Forbes).

- 49% of Prime members spend $800 or more per year (Business Insider).

- 41% of Prime members exceed $800 in spending during the first year (Business Insider).

- Prime uses a free shipping threshold that starts at $35 per purchase (Fast Company).

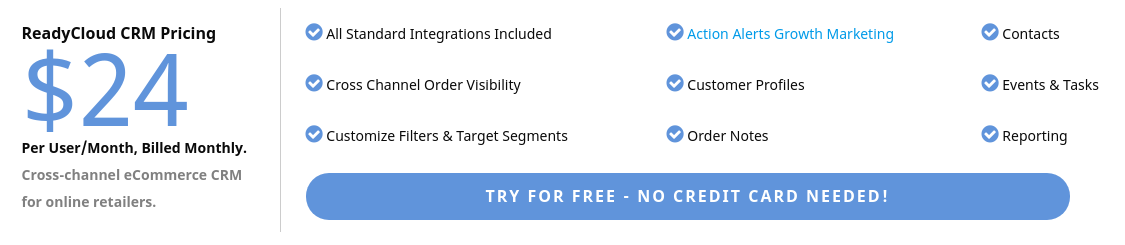

Mobile Shopping & Purchases

Mobile shopping has become the focal point for retailers as they strive to meet the growing demand by consumers, who want to point-and-click their way to purchases via their smartphone or tablet device. Telling of this popularity is a Mashable report identifying what apps are most favored and used by smartphone users. Google takes first place at 92%, followed by Facebook at 84.6% and Yahoo at 83.2%. Firmly in fourth place is Amazon at 68.6%.

But just how popular is mobile shopping on Amazon? A Marketing Land article found that 70% of Amazon shoppers favored their smartphone for making purchases this past holiday season. This comes as no surprise, as Internet Retailer reports that 30% of ecommerce traffic is mobile commerce. With 44% of shoppers starting their retail search at Amazon, and with about 70% of them using a smartphone, it’s no wonder why mobile sales are soaring for this marketplace. Unsurprisingly, as the chart below reflects, Amazon leads the pack here as well.

But just how popular is mobile shopping on Amazon? A Marketing Land article found that 70% of Amazon shoppers favored their smartphone for making purchases this past holiday season. This comes as no surprise, as Internet Retailer reports that 30% of ecommerce traffic is mobile commerce. With 44% of shoppers starting their retail search at Amazon, and with about 70% of them using a smartphone, it’s no wonder why mobile sales are soaring for this marketplace. Unsurprisingly, as the chart below reflects, Amazon leads the pack here as well.

Domination Of The Market

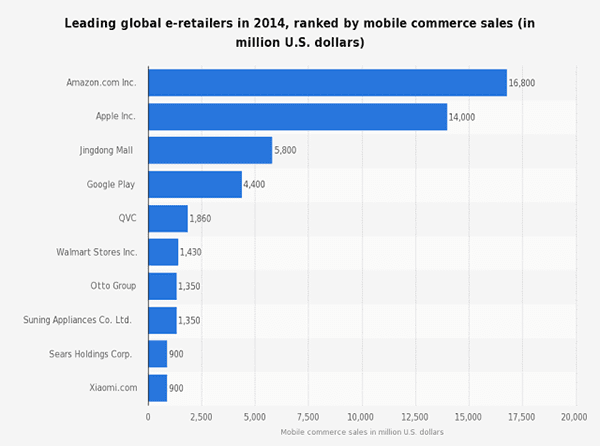

Just how big has Amazon grown to be? In the two decades that it’s been around, it has continued to grow at a record-setting pace. The major news outlets are reporting that Amazon is bigger than Walmart. Now this report was based upon publically traded shares of stock, which can and do fluctuate at any given time. As of the reporting, however, the shares of Amazon were up 14% over Walmart. Respectively, Amazon is worth about $250 billion, whereas Walmart is worth about $230 billion.

A late Q3 Forbes report from 2015 is also telling. During the year-to-date, as of the reporting of that article, Amazon’s stock had soared by a whopping 70% in just nine months. The report attributed a sizeable portion of that growth to the Prime subscription model and forthcoming innovations that the company was dabbling in, such as the Dash Button for instant reordering and Amazon Prime Air. To put this into even better perspective, over 2 billion products were purchased from Amazon in 2014.

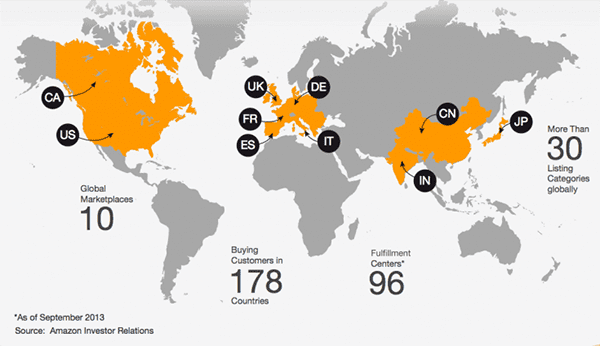

Expanding Global Reach

Amazon is a global force, perhaps the biggest ever seen in retail. Its global reach has had some ups and downs in recent years, though. For example, 37% of Amazon’s sales came from the international markets in 2014, but have declined in recent years. This pitter patter has confused investors, who wonder what the market share will be in the future.

As the above chart reflects, between 2003 and 2014, international growth (the red line) dropped quite substantially. But experts are predicting that it will be back on course during this current year. They say that global growth could increase by 3% or decreased by 10%, setting share prices at either $555 with a 3% growth or hampering them at just $455 with a decline. All told, the take for 2014 on international sales was $34.5 billion.

As the above chart reflects, between 2003 and 2014, international growth (the red line) dropped quite substantially. But experts are predicting that it will be back on course during this current year. They say that global growth could increase by 3% or decreased by 10%, setting share prices at either $555 with a 3% growth or hampering them at just $455 with a decline. All told, the take for 2014 on international sales was $34.5 billion.

Creating A New Worldwide Delivery Service

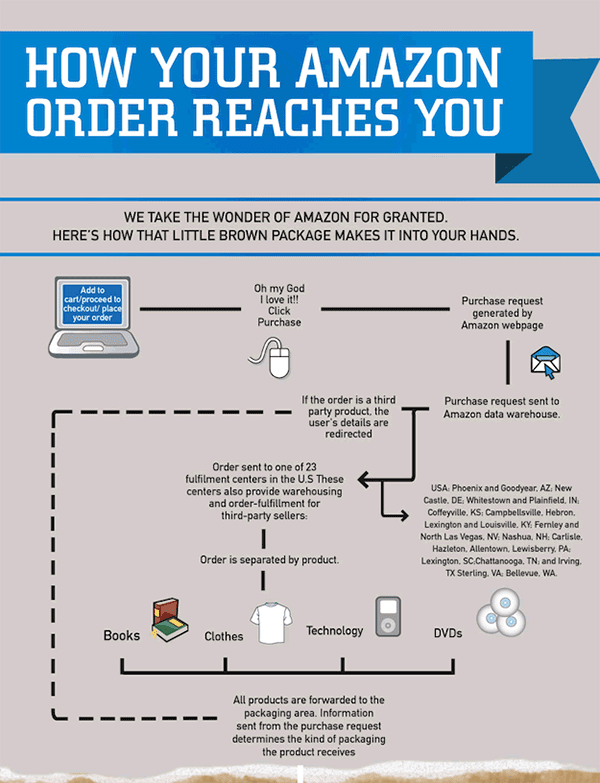

Could Amazon be hard at work creating a new international shipping carrier? All signs point to yes. The news first broke on TT News, citing that the “speculation has mounted” that Amazon has plans in the works to launch a global shipping and logistics service. The goal: to compete with USPS, UPS and FedEx.

Amazon has been mum on the issue so far, saying that they are not planning to replace any of their shipping partners, but are instead looking to supplement the shipping services they provide. This would include during peak holiday shopping times and during other times when inbound orders influx.

They originally called the plan a “Global Supply Chain.” It was revealed/leaked in a tell-all Bloomberg article. It entails a method of creating a new logistics supercenter that enables suppliers and merchants alike to schedule private deliveries of their goods by using their smart devices or computers, and in just a few clicks, nonetheless.

“Sellers will no longer book with DHL, UPS or Fedex but will book directly with Amazon The ease and transparency of this disintermediation will be revolutionary and sellers will flock to FBA given the competitive pricing,” the Bloomberg article cited.

In the future, this could mean that there’s a new international carrier that also happens to own the largest ecommerce marketplace. It could bring about a whole new era of competition that creates the most dangerous rival that the larger carriers have ever seen.

“This is classic Amazon fashion,” said Colin Sebastian, an analyst at Robert W. Baird & Co., in an interview with Bloomberg. “They take baby steps along a long path, which allows some companies that could be disrupted to remain in a sense of denial. Amazon rarely takes one big step forward that shocks the market.”

Given the proximity of the shipping effort involved at Amazon to get orders fulfilled, being able to own a dedicated shipping carrier would make a lot of sense. Take a look at this infographic below to get a better idea of what goes into processing and shipping orders at this retail giant.

Cyber Monday Better Termed as “Amazon Monday”

Now you may be thinking, well there are plenty of other retailers out there that made out like bandits this past Black Friday. Yup, there most certainly were. But none made out like Amazon did. In fact, others didn’t even come close. According to Tech Crunch, Amazon accounted for 36% of all Black Friday sales this past year. And that’s not even counting Cyber Monday. But hold on, we’ll get to that as well.

On Cyber Monday, retailers historically compete for the most sales, using the allure of rock-bottom pricing and special deals to attract shoppers. But Amazon has the one-up on all of these sellers, and is the Cyber Monday leader online. In 2015, Amazon sold over $3 billion in goods on just one day thanks to the lucrative deals that they were offering consumers. Not counting the Black Friday statistics, Amazon accounted for 36.1% of all Cyber Monday sales that occurred online.

Zacks.com said it best: “While the holiday weekend was all about Cyber Monday, the day was all about Amazon.”

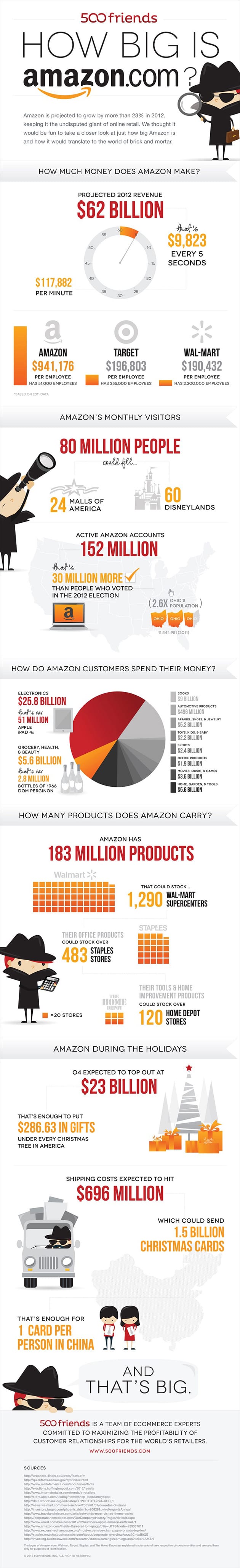

How Big Is Amazon?

So just how big is Amazon? We’ll leave the telling of that tale to this infographic, courtesy of 500 Friends. Feeling overwhelmed? Read our guide on 9 Reasons Why Amazon is Outselling You, so you can learn how to sell like a pro.

Share On: